English Shorthand Dictation “Interpreting a State Law” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

English Shorthand Dictation “Interpreting a State Law” 80 and 100 wpm

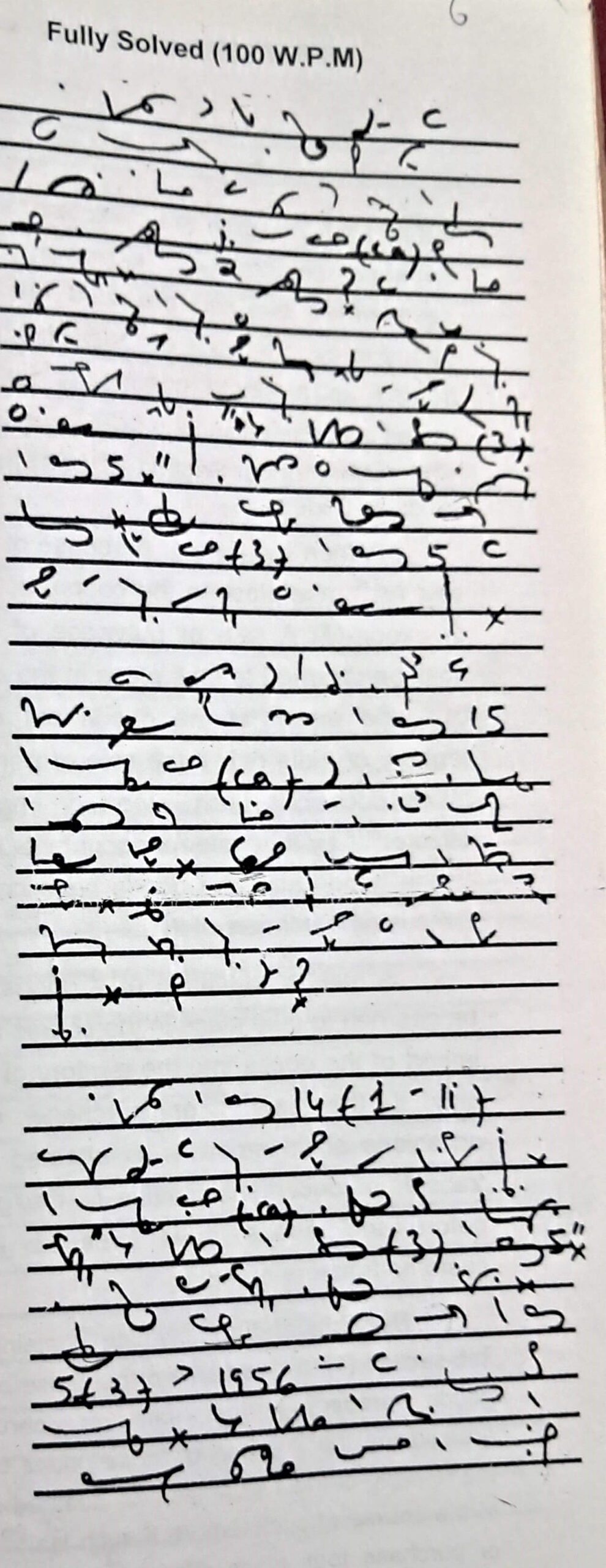

A perusal of the above provisions shows that while interpreting a State law which imposes a tax on the sale or purchase of declared goods, 25 the restriction contained in clause (ca) has to be kept in view. What is the restriction? When a tax on sale or purchase of paddy 50 is leviable under the State law and the rice “procured out of such paddy is exported out of India, paddy and rice shall be treated 75 as a single commodity “for the purposes of sub-section (3) of Section 5″. The Parliament has introduced a limited fiction. It is only in respect 100 of the transaction covered by clause (3) of Section 5 that rice and paddy are treated as a single commodity.

Section 5″. The Parliament has introduced a limited fiction. It is only in respect 100 of the transaction covered by clause (3) of Section 5 that rice and paddy are treated as a single commodity.

Mr. Sarin was at pains 125 to point out that the primary reason for amendment of Section 15 by introducing Clause (ca) was to grant the “benefit of exemption from tax”150 and to avoid indirect taxing of rice. This was intended to promote export. Thus, the counsel contended that the respondents cannot be permitted to treat 175 paddy and rice as two separate commodities. is it so?

A perusal of Section 14 (i and ii) clearly shows that paddy and rice are 200 two separate commodities. By introducing Clause (ca), the distinction has been fictionally obliterated “for the purposes of subsection (3) of Section 5”. The provision has 225 not obliterated the distinction completely. It is only in respect of the cases covered by Section 5(3) of the 1956 Act that a fiction has 250 been introduced. For the purpose of levy of Central Sales Tax in case of inter-State trade, paddy and rice are still two separate commodities. However,” in a case where the rice procured out of the paddy is exported out of India, the two are treated as a single commodity for 300 the limited purpose of Section 5(3).

What does Section 5 postulate? It reads as under:-

“When is a sale or purchase of goods said to 325 take place in the course of import or export-(1) A sale or purchase of goods shall be deemed to take place in the course of 350 the export of the goods out of the territory of India only if the sale or purchase either occasions such export or import is effected 375 by a transfer of documents of title to the goods after the goods have crossed the customs frontiers of India.

A sale or purchase of goods shall be deemed to take place in the course of the import of the goods into the territory of India only if the sale 425 or purchase either occasions such import or is effected by a transfer of documents of title to the goods before the goods have crossed the 450 customs frontiers of India.

Notwithstanding anything contained in sub-section (1), the last sale or purchase of any goods preceding the sale or purchase occasioning the 75 export of those goods out of the territory of India shall also be deemed to be in the course of such export, if such last 500 sale or purchase took place after, and was for the purchase of complying with, the agreement or order for or in relation to such export.” (Words 525)