Sample Paper of Accountancy 2014 for class 12, CBSE.

Sample Paper – 2014

Class – XII

Subject – Accountancy

MEANING OF FINANCIAL STATEMENT

Financial statement are the summarized statement of the accounting data produced at the end of the accounting process by an enterprises through which it communicates the accounting information to the internal & external users.

“Financial statement is prepared for the purpose for presenting a periodical review or report on progress mode by management band deal with the status of management and deal with the status of investment in the business and the result achieved during the period under review.” —American institute of certified public Accountants (AICPA)

- Nature of Financial Statements

The information and data included in the Financial statements are the result the combination of:

- RECORDING FACTS

- CONVENTIONS

- ACCOUNTING CONCEPT

- PERSONAL JUDGEMENTS

- CONTENTS OF ANNUAL REPORTS

Let us the discuss each of the Contents of Annual Report:-

- REPORTS BY THE BOARD OF DIRECTOR

The companies act, 1956 requires every company tom hold a meeting of its Share holders every year. The contents of the Directors Report are specified in the companies act.

- AUDITORS REPORT TO THE SHAREHOLDERS

An auditor of the company, on the basis of examination of the books of account and information obtained, forms his opinion on the annual accounts i.e. Balance Sheet and Profit & loss Account. He expresses his opinion in his report issued to the shareholders of the company under section 227(2) of the companies act.

- BALANCE SHEET

Balance Sheet of the company is prepared following the same Principals are as followed in the preparation of the balance sheet of a sole proprietor or a partnership firm but presented in the form prescribed in SCHDULE VI IF THE COMPANIES ACT 1956.

FORMAT OF THE BALANCE SHEET (HORIZONTAL FORM)

(UNDER SCHDULE VI IF THE COMPANIES ACT 1956.)

| LIABILITIES | ASSETS |

| (1). Share Capital

— Equity Share Capital ++++ — Preference Share Capital ++++ |

(1). Fixed Capital

— Goodwill ++++ — Land & Building ++++ — Plant & Machinery ++++ — Patents, Trademarks etc. ++++ |

| (2). Reserve & Surplus

— Capital Reserve ++++ — Capital Redemption reserve ++++ — Securities Premium ++++ — Profit & Loss a/c (Cr. Bal) ++++ |

(2). Investment. ++++ |

| (3). Secured Loans

— Debentures ++++ — Loans & Advances ++++

|

(3). Current Assets, Loans &Advances

A. CURRENT ASSETS — Stores & Spares ++++ — Loose Tools ++++ — Stock-in-Trade ++++ — Work-in-Progress ++++ — Sundry debtors ++++ — Cash & Bank Balances ++++ B. Loans & Advances — Bills of Exchange ++++ — Loans & Advances ++++ |

| (4). Unsecured Loans

— Fixed Deposit ++++ — Short Term Loans &Advances ++++ |

(4). Miscellaneous Expenditure

— Preliminary expenses ++++ —Expenses including Commission or Brokerage ++++ — Discount on issue Shares/Debentures +++

(2). |

|

(5). Current Liabilities & Provision A.CURRENT LIABILITIES: — Bills Payable ++++ — Sundry Creditors ++++ — Unclaimed Dividends ++++ B.PROVISIONS: — Provision For Taxation ++++ — Proposed Dividends ++++ — For Contingencies ++++ |

(5). Profit & Loss Account ++++ (This is shown only when its debit balance could not be written off) |

NOTE: A footnote to the Balance Sheet is added to show Separately the CONTIGENT LIABILITIES.

- FORMAT OF THE BALANCE SHEET (VERTICAL FORM)

(UNDER SCHDULE VI IF THE COMPANIES ACT 1956.)

| (A). SOURCES OF FUNDS

(1). Shareholder Funds — Capital ++++ — Reserve & Surplus ++++ (2). Loans Funds — Secured Loans ++++ — Unsecured Loans ++++ |

AMOUNT(RS) |

| (B). APPLICATIONS OF FUNDS

(1). Fixed Assets — Goodwill ++++ — Land & Building ++++ — Furniture & Fitting ++++ — Patents, Trademarks ++++ — Lease holds etc. ++++ (2). Investment ++++ (3). Current assets Loans & Advances ( As shown above) (4). Miscellaneous Expenditure ++++ (5). Profit & Loss a/c ++++ |

REMEMBER:- “SCHDULE VI OF BALANCE SHEET” is the Procedure of the Balance Sheet. So it will be followed as LINE-WISE as given as above whether it is Horizontal Form or it is Vertical form. The Procedure will not be changed.

To Remember the Procedure of BALANCE SHEET, there are TWO LINES

FOR LIABILITIES SIDE

“SH.RAM SHARMA UNIVERSITY COACH OF PUNJAB”

- ————- SHARE CAPITAL

RAM————- RESERVE & SURPLUS

SHARMA———-SECURED LOANS

UNIVERSITY———UNSECURED LOANS

COACH OF PUNJAB—-CURRENT LIABILITIES &PROVISION

FOR ASSETS SIDE

“FICA-LAMP”

F——————— FIXED ASSETS

I———————- INVESTMENTS

CA——————- CURRENT ASSETS

LA——————- LOANS & PROVISIONS

M——————– MISCELLANEOUS

P——————— PROFIT & LOSS

- Profit &Loss a/c 5.Notes to Accounts 6.Cash Flow Statement 7.Segement Report (FOR ANY DETAIL CONTACT ME ON:-9888-988-024)

- WHAT IS THE LIMITATIONS OF FINANCIAL STATEMENTS (V.V.IMP) (4).

- TOOLS/TECHNIQUES OF FINANCIAL STATEMENT ANALYSIS

As we know financial statements present only absolute figures which are expressed in terms of money. To make them simpler and in understandable form, various tools/techniques are used for the purpose of analyzing the financial statements.

- The Most commonly used tools for analyzing are as follows:-

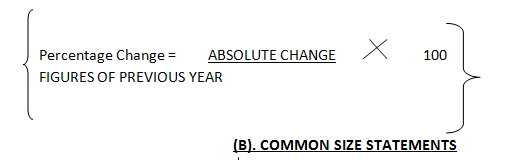

(1). COMPARATIVE STATEMENTS:-These statements may be prepared for the purpose of comparing financial position with the help of figures of various Assets & Liabilities between two years. It is also called “HORIZONTAL ANALYSIS”.

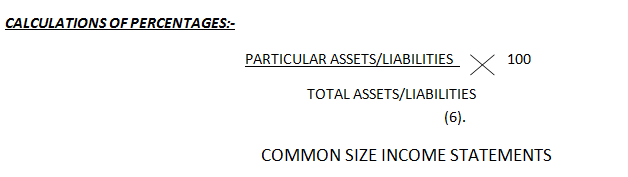

(2). COMMON SIZE STATEMENTS:- Statements which tell about the relationship of various items of a financial statements which some common item. It is also called “VERTICAL ANALYSIS”.

(3). TREND ANALYSIS:- When profitability and financial position over a series of years are studied then it is calls Trend Analysis. In this any one year is taken as ‘BASE YEARS’ and every item of base year is assumed to be equal to 100 and on the basis of percentage of every item of all the years is calculated.

(4). RATIO ANALYSIS:– It is expressing the relationship/w various item of ‘P & L’a/c and BALANCE-SHEET. It is one of the most important tools.

(5). CASH FLOW ANALYSIS:- when cash flow into the business it is called POSTIVE cash flow or cash inflow and when cash out of the business then it is called NEGATIVE cash flow. It is prepared to know the reasons of cash inflow and cash outflow.

IN THIS CHAPTER WE WILL DISCUSS ONLY ABOUT THE COMPARATIVE STATENENTS, COMMONSIZE STATEMENTS &TREND ANALYSIS. THE RATIO ANALYSIS & CASH FLOW STATEMENT WILL BE DISCUSSED IN NEXT CHAPTER SEPARTELY.

Let us discussed one by One”-

(A). COMPARATIVE STATEMENTS

COMPARATIVE BALANCE SHEET COMPARATIVE INCOME STATEMENT

FORMAT OF COMPARATIVE BALANCE SHEET (with imaginary figures) as on____ __ __

| PARTICULARS | PREVIOUS YEAR

(RS) |

CURRENT YEAR

(RS) |

ABSOLUTE CHANGE (RS) | PERCENTAGE CHANGE % | |||

| A. FIXED ASSETS

B. INVESTMENTS C.WORKING CAPITAL (I.e. CURRENTASSETS-CURREN LIAB.) D. CAPITAL EMPLOYED (A+B+C) E.LESS:-LONG TERM DEBTS (E.G.DEBENTURES) F.SHAREHOLDERS FUNDS PREF. SHARE CAPITAL RESERVE & SURPLUS G.SHAREHOLDERS FUND |

12,00,000

3,00,000 3,00,000

18,00,000

6,00,000

12,00,000

6,00,000 4,00,000 3,00,000 13,00,000 |

15,00,000

3,00,000 6,00,000

24,00,000

6,00,000

18,00,000

9,00,000 2,00,000 3,00,000 14,00,000 |

3,00,000

————— 3,00,000

6,00,000

—————

6,00,000

3,00,000 (2,00,000) ————— 1,00,000 |

25*

———- 100

33.33

————

50

50 (50) ———- 7.6 |

- ANALYSIS AND INTERPREATION:-

When the above said statements is prepared whether that is COMPARATIVE STATEMENTS OR COMNMON SIZE STATEMENTS the analysis of the particular items and their interpretation is necessity because that is shows what is actually happened in the solution given by you.

The analysis &interpretation of above comparative balance sheet gives the following solution:-

- Total fixed assets were increased by Rs.3, 00,000.i.e.25% increased in the fixed assets. This was financed by issue of the equity shares. The expansion of fixed assets may have resulted in increased plant capacity or decreased unit cost of production.

- The working capital increased is by Rs. 3, 00,000 i.e. 100% thus it appears to be satisfactory from the point of view of the capacity of business to pay of its current liabilities.

- Capital employed is increased by 33.33% due to 25% increased in fixed assets.

(To know details about Analysis &Interpretation Call Me on:-9888-988-024)

Operating Expenses:-Its refers to the Indirect expenses relating to the principal revenue producing activities of the enterprises.

Non-Operating Income:-Its refer to the income which are not from the principal revenue producing activities.

Non-Operating Expenses:-Its refer to the expenses and losses which are not related to the operated activities e.g. Intangible Assets, Loss on Sale of Assets

(3).

COMPARATIVE INCOME STATEMENTS

FORMAT OF COMPARATIVE INCOME STATEMENTS (with imaginary figures) as on____ __ __

| PARTICULARS | PREVIOUS YEAR

(RS) |

CURRENT YEAR

(RS) |

ABSOLUTE

CHANGE |

PERCENTAGE

CHANGE |

| NET SALES*

LESS:COST OF GOODS SOLD** |

54,00,000

4,00,000 |

36,00,000

6,00,000 |

(18,00,000)

2,00,000

|

(33.33)

50 |

| GROSS PROFIT

LESS:OPERATING EXPENSES*** |

50,00,000

10,00,000 |

30,00,000

5,00,000 |

(20,00,000)

(5,00,000) |

(40)

(50) |

| NET OPERATING PROFITS

ADD:OTHER INCOME LESS:NON-OPERATING EXPENSES |

40,00,000

5,00,000

6,00,000 |

25,00,000

6,00,000

4,00,000 |

(15,00,000)

1,00,000

(2,00,000) |

(37.5)

20

(33.33) |

| PROFIT BEFORE INTEREST

AND TAX LESS:INTEREST PAID |

39,00,000 9,00,000 |

27,00,000 11,00,000 |

(12,00,000) 2,00,000 |

(30.76) 22.22 |

| PROFIT BEFORE TAX

INCOME TAX PAID(50%) |

30,00,000

15,00,000 |

16,00,000

8,00,000 |

(14,00,000)

(7,00,000) |

(46.66)

(46.66) |

PROFIT AFTER TAX 15,00,000 8,00,000 (7,00,000) (46.66)

NOTES:–

*NET SALES=GROSS SALES (CASH &CREDIT SALES)-SALES RETURN

**COST OF GOODS SOLD=OPENING STOCK+NET PURCHASE+DIRECT EXPENSES-CLOSING STOCK

*** OPERATING EXPENSES: OFFICE, ADMNISTRATION, SELLING&DISTRIBUTION

FORMAT Of COMMON SIZE BALANCE SHEET (with imaginary figures) as on____ __ __

| PARTICULARS | PREVIOUS YEAR

(RS) |

CURRENT YEAR

(RS) |

PERCENTAGE CHANGE

(2008) (RS) |

PERCENTAGE CHANGE

(2009) (RS) |

| ASSETS.

FIXED ASSETS INVESTMENT CURRENT ASSETS TOTAL LIABILITIES SHARE CAPITAL —EQUITY SH.CAPITAL —PREF.SH.CAPITAL RESERVE &SURPLUS SECURED LOANS UNSECURED LOANS CURRENT LIABILITIES PROVISION

|

3,00,000 2,00,000 1,00,000 6,00,000

1,50,000 1,50,000 20,000 1,00,000 50,000 1,00,000 30,000 6,00,000

|

7,50,000 1,00,000 2,10,000 10,60,000

4,00,000 1,00,000 1,50,000 1,80,000 1,20,000 88,000 22,000 10,60,000

|

50 33.33 16.77 100

25 25 3.33 16.66 8.33 16.66 5 100

|

70.75 9.43 19.82 100

37.73 9.43 14.15 16.98 11.33 8.3 2.08 100

|