Previous Year Question Paper with Answer of “Introduction To Financial Market – Code 405” for Class 10 NSQF Vocational, CBSE Session 2021-2022.

CBSE| Vocational Education

Introduction To Financial Market – Code 405

Class 10

(Session 2021-2022)

Previous Year Solved Question Paper for Term – 2

Max. Time Allowed: 1 Hour (60 Min) Max. Marks: 25

General Instructions:

- Please read the instructions carefully

- This Question Paper is divided into 03 sections, viz., Section A, Section B and Section C.

- Section A is of 05 marks and has 06 questions on Employability Skills.

- a) Questions numbers 1 to 4 are one mark questions. Attempt any three questions.

- b) Questions numbers 5 and 6 are two marks questions. Attempt any one question.

- Section B is of 12 marks and has 12 questions on Subject Specific Skills.

- a) Questions numbers 7 to 12 are one mark questions. Attempt any four questions.

- b) Questions numbers 13 to 18 are two marks questions. Attempt any four questions.

- Section C is of 08 marks and has 03 competency-based questions.

- a) Questions numbers 19 to 21 are four marks questions. Attempt any two questions.

- Do as per the instructions given in the respective sections.

- Marks allotted are mentioned against each section/question.

SECTION A

(3 + 2 = 5 marks)

Answer any 3 questions out of the given 4 questions. Each question is of mark. 1 x 3 = 3

Q.1 “One is running a business to satisfy the needs of people and looking for ways to make the business better to make profits” What is the type of self-employment? 1

Q.2 Write the two advantages of Entrepreneurs. 1

Q.3 What is Sustainable Development? 1

Q.4 What do you mean by Sustainable Development Goals? 1

Answer any 1 question out of the given 2 questions. Each question is of mark. 2 x 1 = 2

Q.5 How do the Entrepreneurs help the society? 2

Q.6 Suggest Sustainable Cities and Communities. 2

SECTION B

(4 + 8 = 12 marks)

Answer any 04 questions out of the given 06 questions 1 x 4 = 4

Q.7 Name the depositary of National Stock Exchange 1

Q.8 What is an ETF? 1

Q.9 What is Pay-in Day? 1

Q.10 What is an Annual Report? 1

Q.11 Define liquidity. 1

Q.12 What Current ratio measure? 1

Answer any 04 questions out of the given 06 questions 2 x 4 = 8

Q.13 Who is a Depository Participant (DP)? 2

Q.14 What is Active Fund Management? 2

Q.15 What is an Investor Protection Fund? 2

Q.16 Write the two sources of funds companies rises. 2

Q.17 What is the difference between secured and unsecured loans under Loan Funds? 2

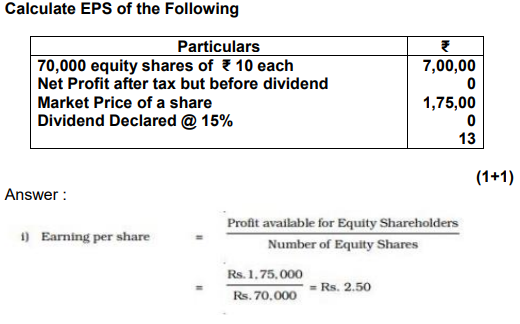

Q.18 Calculate EPS of the Following: 2

SECTION C

(2 x 4 = 8 marks)

(COMPETENCY-BASED QUESTIONS)

Answer any 02 questions out of the given 03 questions

Q.19 “Mutual Fund is subject to market risk; read all documents carefully before invest”. You must aware about debt market mutual fund investment risks describe each in brief. 4

Q.20 “Buyback also known a share repurchase, is when a company buys its own outstanding shares to reduce the number of shares available on the open market). Why it Buyback? How does company buy it? 4

Q.21 “Company Analysis! Now, this is a really important to discuss if you are looking to create long-term wealth out of stocks. For long-term wealth creation, it is extremely important to understand the company you are going to invest in”. How to go about systematically analyzing a company? 4

ANSWERS

SECTION A

(3 + 2 = 5 marks)

Answer any 3 questions out of the given 4 questions. Each question is of mark. 1 x 3 = 3

Q1.

Answer: Entrepreneurship 1

Q.2 Answer:

Fulfill Customer Needs(1/2)

Create Jobs(1/2) 1

Q.3 Answer: Sustainable development is the development that satisfies the needs of the present without compromising the capacity of future generations.1

Q.4 Answer: The Sustainable Development Goals (SDGs) are a universal call of action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity. 1

Answer any 1 question out of the given 2 questions. Each question is of mark. 2 x 1 = 2

Q.5 Answer: Entrepreneurs have a positive relationship with society. Some entrepreneurs work towards saving the environment, some give money to build schools and hospitals. This way, the people and area around them become better. (1+1)

Q.6

Answer:

Save energy by switching off lights and fans when not in use.(1)

Use energy efficient lights (LED bulbs) and appliances.(1)

SECTION B

(4 + 8 = 12 marks)

Answer any 04 questions out of the given 06 questions 1 x 4 = 4

Q.7 Answer: National Securities Depository Limited (NSDL) 1

Q.8 Answer: An exchange-traded fund as a mutual fund that trades like a stock. 1

Q.9 Answer: Pay-in day is the day when the securities sold are delivered to the exchange by the sellers. 1

Q.10 Answer: An annual report is a formal financial statement issued yearly by a corporate. 1

Q.11 Answer: Liquidity refers to the ability of a firm to meet its financial obligations in the short-term which is less than a year. 1

Q.12 Answer: The current ratio measures the ability of the firm to meet its current liabilities from the current assets. 1

Answer any 04 questions out of the given 06 questions 2 x 4 = 8

Q.13 Answer: The Depository provides its services to investors through its agents called depository participants (DPs). (1)

These agents are appointed by the depository with the approval of SEBI. Banks, Financial Institutions and SEBI registered trading members can become DPs.(1)

Q.14 Answer: When investment decisions of the fund are at the discretion of a fund manager(s) and he or she decides which company, instrument or class of assets the fund should invest in based on research, analysis, and market news etc. such a fund is called as an actively managed fund. 2

Q.15 Answer: Investor Protection Fund (IPF) is maintained by NSE to make good investor claims, which may arise out of non-settlement of obligations by the trading member, who has been declared a defaulter, in respect of trades executed on the Exchange.(1)

The maximum amount of claim payable from the IPF to the investor (where the trading member through whom the investor has dealt is declared a defaulter) is Rs.25 lakh.(1)

Q.16 Answer:

Shareholders’ Fund (also known as Net Worth) is the fund coming from the owners of the company (1)

Loan Fund is the fund borrowed from outsiders. (1)

Q.17 Answer:

Secured loans are the borrowings against the security i.e. against mortgaging some immovable property or hypothecating/pledging some movable property of the company. (1)

Unsecured loans are other *‘short term borrowings without a specific security. They are fixed deposits, loans and advances from promoters, inter-corporate borrowings, and unsecured loans from the banks.(1)

Q.18

SECTION C

(2 x 4 = 8 marks)

(COMPETENCY-BASED QUESTIONS)

Answer any 02 questions out of the given 03 questions

Q.19

Answer:

Mutual Funds do not provide assured returns. Their returns are linked to their performance. They invest in shares, debentures, bonds etc. All these investments involve an element of risk.

Some of the Risk to which Mutual Funds are exposed to is given below:

Market risk: If the overall stock or bond markets fall on account of overall economic factors, the value of stock or bond holdings in the fund’s portfolio can drop, thereby impacting the fund performance.(1)

Non-market risk: Bad news about an individual company can pull down its stock price, which can negatively affect fund holdings. (1)

Interest rate risk: Bond prices and interest rates move in opposite directions. When interest rates rise, bond prices fall and this decline in underlying securities affects the fund negatively. (1)

Credit risk: Bonds are debt obligations. So when the funds invest in corporate bonds, they run the risk of the corporate defaulting on their interest and principal payment obligations. (1)

Q.20

Answer: A buyback can be seen as a method for company to invest in itself by buying shares from other investors in the market. Buybacks reduce the number of shares outstanding in the market. Buy back is done by the company with the purpose to improve the liquidity in its shares and enhance the shareholders’ wealth. (1)

Under the SEBI (Buy Back of Securities) Regulation, 1998, a company is permitted to buy back its share from:

- a) Existing shareholders on a proportionate basis through the offer document. (1)

- b) Open market through stock exchanges using book building process. (1)

- c) Shareholders holding odd lot shares. (1)

Q.21

Answer:

Industry Analysis: Companies producing similar products are subset (form a part) of an Industry/Sector. It is very important to see how the industry to which the company belongs is faring. Specifics like effect of Government policy, future demand of its products etc. need to be checked. (1)

Corporate Analysis: How has the company been faring over the past few years? Seek information on its current operations, managerial capabilities, growth plans, its past performance vis-a-vis its competitors etc. This is known as Corporate Analysis. (1)

Financial Analysis: If performance of an industry as well as of the company seems good, then check if at the current price, the share is a good buy. For this look at the financial performance of the company and certain key financial parameters like Earnings Per Share (EPS), P/E ratio, current size of equity etc. for arriving at the estimated future price. (2)