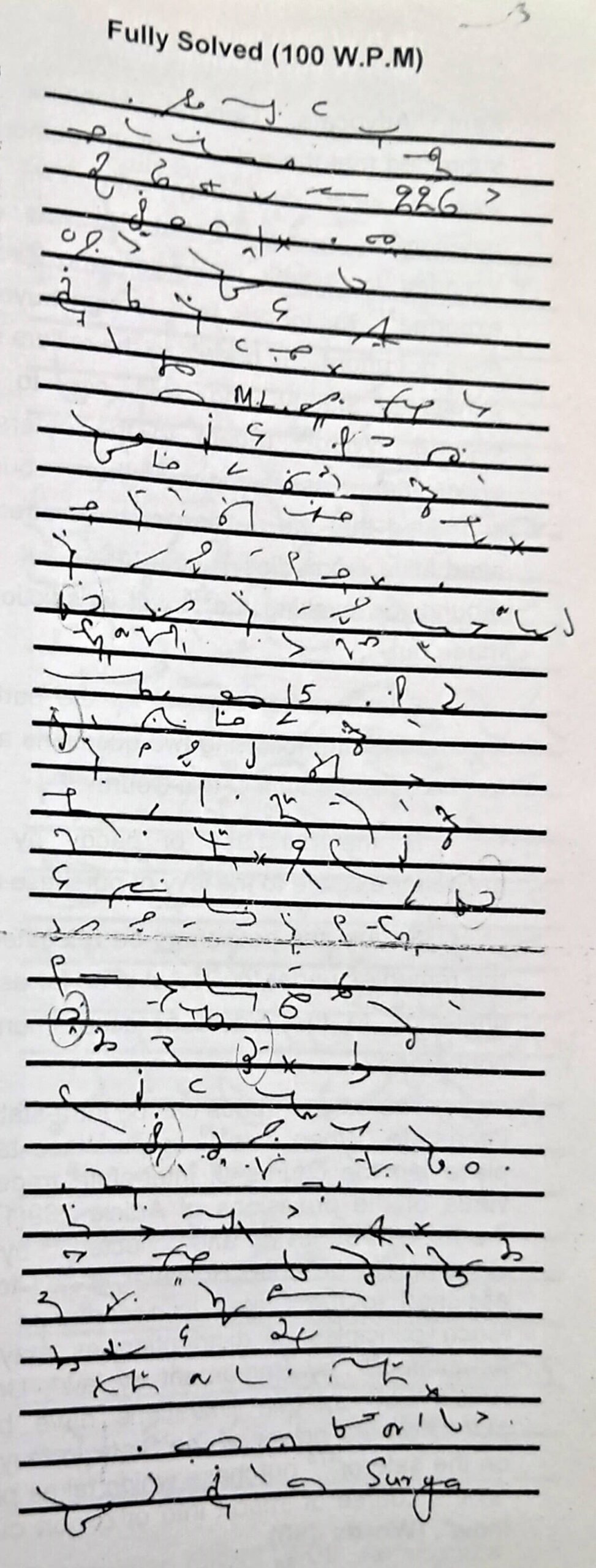

English Shorthand Dictation “Extra-ordinary Jurisdiction” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

English Shorthand Dictation “Extra-ordinary Jurisdiction” 80 and 100 wpm

The respondents maintain that no case for invoking the extra-ordinary jurisdiction of this Court under Article 226 of the Constitution is made out. The grounds 25 as raised by the petitioner have been controverted. It is prayed that the writ petition be dismissed with costs.

writ petition be dismissed with costs.

Mr. M.L. Sarin, learned counsel for 50 the petitioners contended that the State cannot impose tax on the sale or purchase of goods bought or sold in the course of export. Paddy are rice and special goods. The distinction between paddy and rice having been obliterated by the Parliament by introducing Section 15, the State was not 100% competent to levy tax on the purchase of paddy as the rice had been sold to the exporter who had a prior order of purchase from a foreign buyer. He further contended that the legal fiction by which the distinction between rice and paddy has been obliterated has to be 150 given full effect and thus, the impugned notices as well as the orders of assessment cannot be sustained. It was further contended that in view175 of the constitutional issues raised in the petitions, the remedy of appeal could not operate as a bar to the maintainability of the writ petition 200 According to the learned counsel, even the orders of provisional assessment were wholly arbitrary as the matter had remained pending with the assessing authority for 225 a long time.

The claim made on behalf of the petitioners was controverted by Mr. Surya Kant, Advocate, General, Haryana. He submitted that the action 250 of the authorities was in strict conformity with law. The amendment in the Central Act was only intended to benefit the miller who directly exported275 the goods to a foreign buyer. It does not afford any benefit to the millers who purchased paddy and sold rice to the exporter. With 300 regard to the orders of provisional assessment, the counsel submitted that the petitioners have effective alternative remedies under the Act. No ground for invoking the 325 writ jurisdiction is made out.

After hearing counsel for the parties, we find that the following two questions arise for the consideration of this Court:-350

Is the purchase of paddy by the petitioner exigible to the levy of purchase tax/

Should the petitioners be relegated to the remedies under the 375 Act in so far as the challenge to the orders of assessment is concerned?

The sale of goods can be intra-state or inter-state. When sale 400 or purchase takes place in the course of inter-state trade by virtue of the provisions of Article 269(1)(g), the tax can be levied and collected 425 by the Government of India. However, it has to be assigned to the States in accordance with formulated 450 “such principles of distribution as may be by Parliament by law”. Under Article 286, certain limitations have been on the sale or 475 placed on the power of the State to levy tax purchase which takes place “in the course of import into or export out of India”. (Words 490)