English Shorthand Dictation “Purchase Tax” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

English Shorthand Dictation “Purchase Tax” 80 and 100 wpm

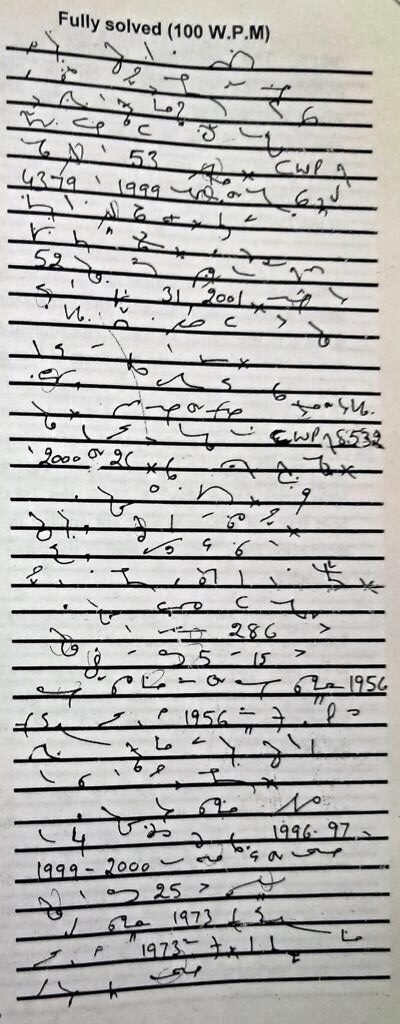

Is the paddy purchased by a miller who sells the rice to the exporter not exigible to the levy of purchase tax? This is the primary question that arises for consideration in this bunch of 53 writ petitions. CWP No. 4379 of 1999involvingthis issue had been admitted by a Bench of this Court. It was on the daily Board of this Bench. The remaining 52 petitions were listed for preliminary hearing on July 31, 2001. Counsel for the parties made a request that all the petitions be heard and disposed of together. Consequently,) we have heard these petitions. Learned counsel for the parties have referred to the facts in CWP No. 8532 of 2000. These may be briefly noticed.

1999involvingthis issue had been admitted by a Bench of this Court. It was on the daily Board of this Bench. The remaining 52 petitions were listed for preliminary hearing on July 31, 2001. Counsel for the parties made a request that all the petitions be heard and disposed of together. Consequently,) we have heard these petitions. Learned counsel for the parties have referred to the facts in CWP No. 8532 of 2000. These may be briefly noticed.

The petitioner has a125 sheller. He is purchases paddy, processes it and sells rice. Herein, we are concerned with the sale of rice to an exporter who sold it150 to a foreign buyer. The petitioner claims that in view of the provisions of Article 286 of the Constitution and Section 5 and 15 of 175 the Central Sales Tax Act, 1956 (hereinafter referred to as the 1956 Act), the State cannot levy purchase tax on the paddy purchased by it 200 for sale of rice to the exporter.

The petitioner filed sales tax returns for four assessment years viz. 1996-97 to 1999-2000 in with the accordance provisions of Section 25 of the Haryana General Sales Tax Act, 1973 (hereinafter referred to as the 1973 Act). It deposited the tax which fell 250 due in accordance with the return. The petitioner claimed that no purchase tax was leviable on the paddy which was shelled to fulfill the contract of sale of rice by the exporter to the foreign buyer. This claim was made on the basis of the provisions of Section 15 and 300 Section 5 of the Central Sales Tax Act.

On August 16, 1999, the Sales Tax Tribunal accepted a similar claim made by a dealer from 325 Sirsa viz. M/s Veerumal Monga & Sons in the matter of Sales Tax Appeal No. 698 of 1998-99. However, the State of Haryana filed a 360 review petition under Section 41 of the Haryana General Sales Tax Act and claimed that the order was contrary to the provisions of law. The plea of the State was accepted. Vide order dated May 15, 2000, the Tribunal held that the assessee was not entitled to the exemption from the payment of purchase tax on paddy.

In pursuance to the order passed by the Tribunal, the assessing authority issued notices to the petitioner to 425 show cause as to why tax, interest, and penalty be not levied. Copies of the notices are at Annexures P.3 to P.6 with the petition.”

The petitioner appears before the Assessing Authority, It produced the necessary forms on record to show that the rice had been actually, exported out of 475 India by the exporter who had a prior order from the foreign buyer. It claims that no tax was leviable. Thus, the question of charging 500 interest or imposing a penalty did not arise. (Words 507)