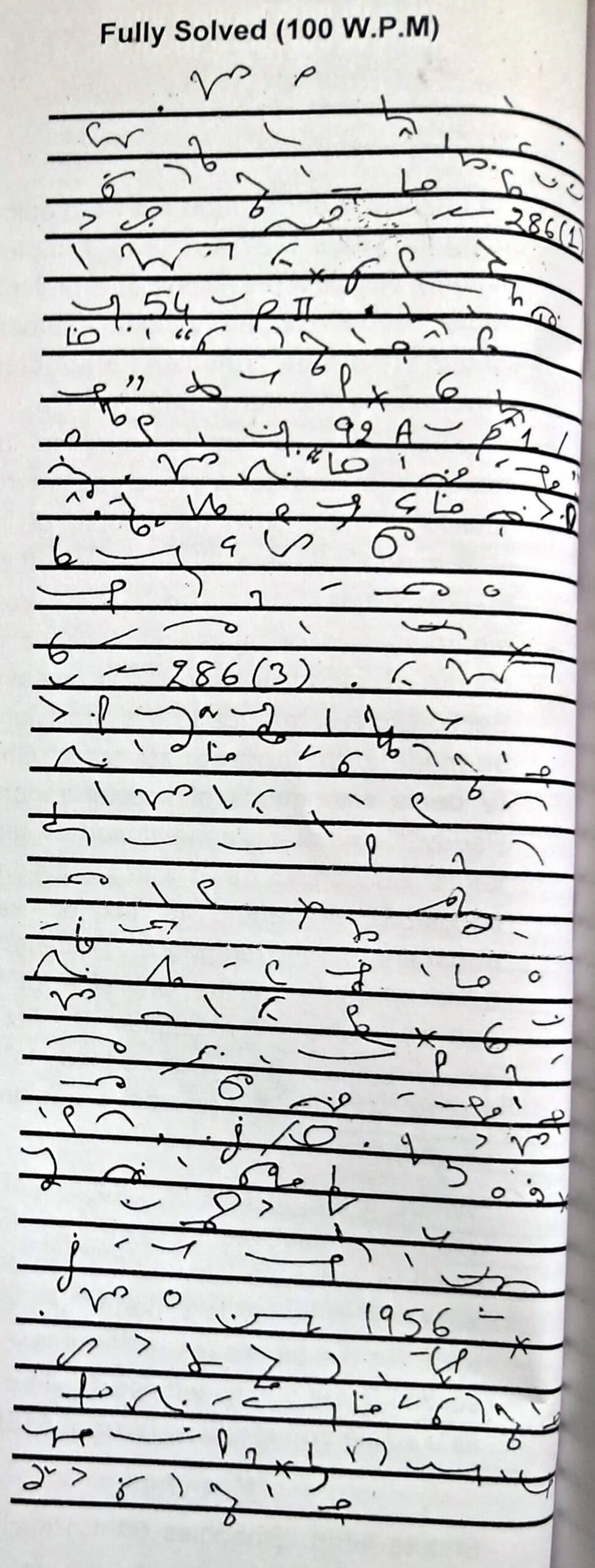

English Shorthand Dictation “Parliament has the Power” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

English Shorthand Dictation “Parliament has the Power” 80 and 100 wpm

The Parliament has the power to formulate principles for determining when a sale or purchase of goods takes place in any of the ways mentioned 25 in Article 286(1) by promulgated law. Still further, by virtue of Entry 54 in List-II, the power to impose taxes on “sale or purchase of 50 goods other than newspapers” vests in the State. This power is subject to Entry 92A in List-1 which empowers the Parliament to levy “taxes on 75 imports and exports”. The obvious purpose is to ensure that the tax imposed by the State does not interfere with the foreign as well as inter-state trade and commerce as these are matters of national importance. Under Article 286(3), the law promulgated by the State in so far as it125 provides for the levy of tax “on the sale or purchase of goods declared by Parliament by law to be of special importance in inter-State trade or commerce.. be subject to such restrictions and conditions in regard to the assessment of levy rates and other incidents of tax as Parliament175 may by law specify”. Thus, in matters relating to inter-State trade and commerce as well as imports and exports of goods of special importance, the 200 Constitution recognises the supremacy of the Parliament in so far as the imposition of sales tax etc. is concerned.

power to impose taxes on “sale or purchase of 50 goods other than newspapers” vests in the State. This power is subject to Entry 92A in List-1 which empowers the Parliament to levy “taxes on 75 imports and exports”. The obvious purpose is to ensure that the tax imposed by the State does not interfere with the foreign as well as inter-state trade and commerce as these are matters of national importance. Under Article 286(3), the law promulgated by the State in so far as it125 provides for the levy of tax “on the sale or purchase of goods declared by Parliament by law to be of special importance in inter-State trade or commerce.. be subject to such restrictions and conditions in regard to the assessment of levy rates and other incidents of tax as Parliament175 may by law specify”. Thus, in matters relating to inter-State trade and commerce as well as imports and exports of goods of special importance, the 200 Constitution recognises the supremacy of the Parliament in so far as the imposition of sales tax etc. is concerned.

In exercise of the power under225 the Constitution and in the interest of national economy, the Parliament has enacted the 1956 Act. Once of the basic objects was to authorise the 250 State Governments to levy and collect tax on the sale or purchase of goods in the course of inter-State trade. It was also intended to 275 fix the size of the sale or purchase of goods.

The provisions of the 1956 Act were enforced during the years 1957 and 1958. Chapter 1300 primarily contains provisions of a preliminary nature. It defines the various expressions used in the Statute. Chapter II embodies the principles “for determining when a sale 325 or purchase of goods takes place in the course of inter-State trade or commerce or outside a State or in the course of import Or350 export”. Chapter III deals with the levy of inter-State sales tax. The provision regarding sale or purchase of goods in the course of import or export375 is contained in Section 5. A reference to this provision shall be made at the appropriate stage. Chapter- IV deals with goods of special importance. Paddy400 and rice are mentioned as separate items. Section 15 deals with restrictions and conditions in regard to tax on sale or purchase of declared goods within a State. It is referable to the provision of Article 286(3)(a) of the Constitution. By Act 33 ci 1996, clause (ca) was added to 450 the provision. Thus, the relevant provision reads as under:-

“Where a tax on sale or purchase of paddy referred to in sub-clause (i) of475 section 14 is leviable under the law and the rice procured out of such paddy is exported out of India, then, for the purchases of 500 sub-section (3) section 5, the paddy and rice shall be treated as a single commodity”. (Words 515)