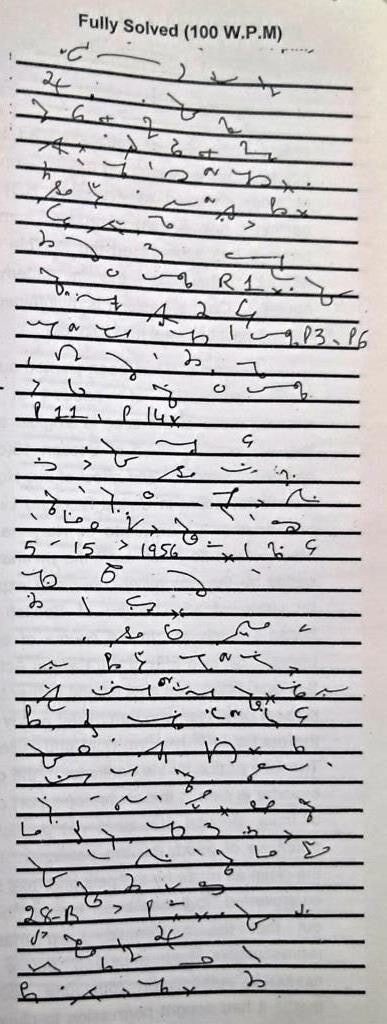

English Shorthand Dictation “Matter was Pending” 80 and 100 wpm Legal Matters Dictation 500 Words with Outlines meaning.

English Shorthand Dictation “Matter was Pending” 80 and 100 wpm

While the matter was pending before the Assessing Authority, the petitioner approached this Court through the present writ petition. A Bench of this Court directed 25 the issue of notice of motion. The respondents filed a written statement. Along with the reply, assessment orders were collectively produced as Annexures R.1. The petitioner amended the writ petition so as to challenge not only the notices at Annexures P.3 to P.6 but also the orders of assessment, copies of which have been produced as Annexures P.11 to P.14.

statement. Along with the reply, assessment orders were collectively produced as Annexures R.1. The petitioner amended the writ petition so as to challenge not only the notices at Annexures P.3 to P.6 but also the orders of assessment, copies of which have been produced as Annexures P.11 to P.14.

The petitioner maintains that the action of the respondents in treating purchase of 100 paddy as eligible to the levy of tax is contrary to the provisions of Sections 5 and 15 (ca) of the 1956 Act. It prays1 that the notices as well as the orders of assessment be quashed.

The respondents’ places reliance on the written statement filed in reply to the 150 original unamended petitions. In this written statement, it has been inter alia averred that the petitioner is a registered dealer. It is engaged in the purchase, husking of paddy and selling of rice. Since the purchase tax had not been paid, notices were issued to the petitioner “for levy of 200 purchase tax by way of provisional assessment under Section 28-B of the State Act. The petitioner did not join proceedings before the assessing authority to 225 represents its case by submitting a reply to the notice. Assessment orders in respect of notices issued to the petitioner were passed on merits, (copies 250 of order enclosed as Annexure R.1). The petitioner has a right of appeal from that order. It has approached the Hon’ble Court without exhausting the 275 remedy of appeal…” On this basis, it is maintained that the writ petition is not maintainable.

On merits, it has been pointed out that the purchase of paddy in the circumstances of the case is eligible to the levy of tax. The effect of Section 15(ca) is only to “over-ride 325 and effect of this Hon’ble Court’s judgment in United Riceland Limited and another v. the State of Haryana and others (1) in as much as 350 the purchase of paddy by the rice miller-cum-direct exporter by virtue of legal fiction of Section 5(3) became purchases in the course of export under375 Section 5(3) of the Central Act. But this legal fiction does not extend further to the present petitioner who purchased paddy from the market in 400 his own right and milled” it. The sale of rice by the petitioner to the direct exporter is sale in the course of export out425 of India. Section 5(3) does not protect the purchase of paddy by the petitioner. Thus, the claim as made by the petitioner has been controverted. It has been further pointed out that the petitioner’s claim that its representative had appeared before the assessing authority on 26th June, 2000 or that 475 it had sought permission to place ‘H’ forms or S.T. 15-A forms on record is false. (Words 500)