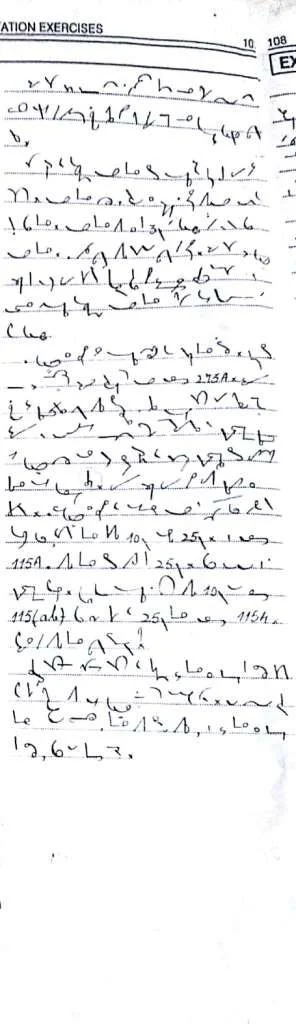

Shorthand Dictation 80 Words per minute with outline, 5 Minute Test 44

I would appeal to you to give me a little more time because there are many important clauses in the 20 Bill which require consideration and it is the last opportunity which we got because after that the Finance Bill will be passed.

I would appeal to you to give me a little more time because there are many important clauses in the 20 Bill which require consideration and it is the last opportunity which we got because after that the Finance Bill will be passed.

I will point out that for the first time interest tax has been introduced although it was done 60 away with much earlier. Interest tax means the banker has to charge a higher rate of interest now for paying 80 this tax. Interest tax rate is at 3 per cent and financial institutions are to pay this interest tax. The 100 result will be, the rate of borrowing will be much higher. I would appeal to the Finance Minister to consider 120 it to see whether it will be advisable at this stage when the country requires generation of capital to increase 140 and introduce for the first time the interest tax particularly for the banking and other financial institutions.

The Finance Minister has 160 suggested and has introduced measures for better tax compliance. Power has been given to the Commissioner to waive penalty or 180 interest under section 273A. When we are considering that the discretionary powers should be reduced as far as 200 possible, it is the industrial policy of our present Government that we are in unshackle the economy from the cobwebs 220 of bureaucratic discretion and the Finance Minister himself in his budget speech pointed out that to much bureaucratization has been 240 one of the major defects in the fiscal administration. We are to consider whether such wide diversion is desirable. The 260 Hon’ble Finance Minister has suggested that in the case of interest of mutual funds received by off-shore funds, that 280 will be taxed at the rate of 10 per cent instead of 25 per cent. But under Section 115A 300 the rate of tax has been retained qt 25 per cent. This is nothing but a bureaucratic oversight. If you 320 have introduced a lower rate of 10 per cent it in section 115 (ab), then you should delete 340 that 15 per cent tax under Section 115A. Otherwise which rate of tax will be applicable?

It 360 has been the policy of the Government and welcome the policy that at the time when the tax is 380 deducted at source it will be either at the prevailing rate under the Finance Act or in any other law. 400 Under many double taxation agreements, tax rate has been reduced, but when the tax is deducted at source, this is 420 not taken account of.